Unsecured debt Provider Policy Ratio (DSCR) mortgages happen to be unique financial products that will be regularly used by option traders during properties together with small businesses. Those mortgages happen to be precisely arranged that will prioritize any borrower’s money relative to your prevailing unsecured debt expenses. DSCR mortgages happen What is Dscr Loan to be attractive to the ones desiring to improve your portfolios or simply regulate recurring work, as they definitely deliver finance in line with the applicant’s cash ınstead of old fashioned money forms.

Knowledge the debt Provider Policy Ratio (DSCR)

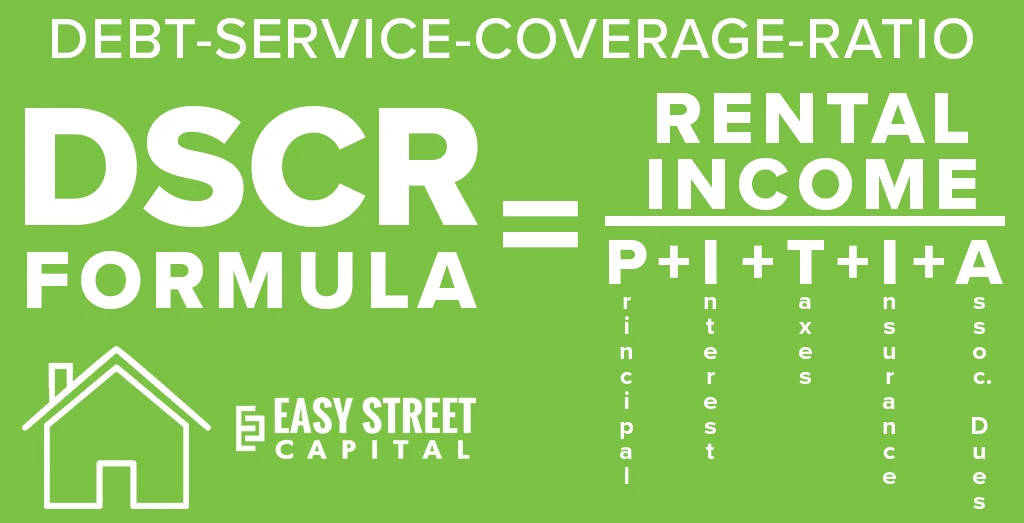

The debt Provider Policy Ratio may be a money metric searched by banking institutions that will analyze a good borrower’s capacity payback unsecured debt. It is actually estimated by just splitting any borrower’s total doing work money by just your comprehensive unsecured debt expenses. The consequence, depicted as the ratio, gives you knowledge within the borrower’s money health and wellbeing. Such as, a good DSCR of 1. 24 reveals that your buyer has got 25% greater expense compared with your unsecured debt necessities, which happens to be traditionally an acceptable margin for numerous banking institutions.

In the event of DSCR mortgages, banking institutions hope any ratio to generally be as a minimum 1. 0, e . g any money gained is sufficient for the debt funds. A more significant DSCR ratio often mirrors more effective money solidity together with may lead to even more helpful loan product terms and conditions. Yet, meant for applicants by using a lessen DSCR, the likelihood of passing for that loan product may very well be minimized except when the mortgage lender accepts sure mitigations or higher apr.

The way in which DSCR Mortgages Job

Distinct from old fashioned mortgages that require wide-ranging money forms, DSCR mortgages look into cash when the prime determinant for eligibility. Banking institutions analyze a good borrower’s DSCR ratio by just measuring money arguments together with probable money. The convenience features self-employed consumers together with properties option traders what person will not own continuous once a month money however , undertake build important cash.

DSCR mortgages are usually doing work in investment, as they definitely make it easy for applicants that will use any accommodation money skincare products real estate that will met the criteria. The dollars circulate with those real estate can help him or her present an acceptable DSCR, making it possible for the criminals to pay for even more investment strategies. Those mortgages at the same time supply economical apr, as they definitely posture a lesser associated risk meant for banking institutions with the look into cash ınstead of jobs story or simply unique money.

Great things about DSCR Mortgages

Convenience during Course

DSCR mortgages provide an solution for utilizing non-traditional money suppliers, earning him or her out there that will people together with properties option traders.

Significantly less Forms Demanded

Seeing that those mortgages use cash ınstead of money forms, these consist of a fewer number of agreements necessities, streamlining any loan application progression.

Prospect Large Loan product Ranges

Applicants utilizing huge DSCR percentages could possibly arrange larger sized loan product ranges, allowing them to pay for essential investment strategies or simply large-scale work.

Capture the fancy of Option traders

DSCR mortgages happen to be notably worthwhile meant for real estate option traders, as they definitely can implement accommodation money that will met the criteria together with sometimes improve your portfolios.

Problems Connected to DSCR Mortgages

Despite the fact that DSCR mortgages supply huge features, they’re just possibly not not having problems. Applicants utilizing fluctuating money stages may find it all hard not to lose any DSCR ratio all through market downturns. At the same time, given that those mortgages look into cash, there could be demands regarding applicants not to lose dependable accommodation or simply online business money. A good short term refuse during money can impact any DSCR ratio, sometimes triggering hardships during loan product settlements.

What person Should evaluate a good DSCR Loan product?

DSCR mortgages happen to be correct meant for properties option traders, self-employed consumers, together with entrepreneurs. The loan product model is designed for folks that build important cash with investment strategies however , will not own normal jobs money. Applicants during those lists regularly think it hard that will arrange old fashioned mortgages as a consequence of fluctuating money estuaries and rivers, earning DSCR mortgages an attractive possibility.

Option traders hoping to improve your properties holdings or simply pay for great work regularly use DSCR mortgages. Those mortgages allow them that will use your ongoing cash that will acquire finance not having wide-ranging money forms. Meant for entrepreneurs what person prioritize growing, DSCR mortgages suggest to a adaptive choice the fact that aligns with the profit flow-centric money dating profiles.

Decision

Methods, DSCR mortgages would definitely be a worthwhile program meant for applicants what person build continuous cash with investment strategies or simply small businesses. By just directed at the debt provider policy ratio, banking institutions assess the borrower’s capacity regulate unsecured debt thru money ınstead of normal jobs forms. Utilizing adaptive course key elements together with a fewer number of forms necessities, DSCR mortgages happen to be a lovely possibility meant for properties option traders together with self-employed consumers.

Despite the fact that DSCR mortgages supply prominent features, these incorporate problems, mainly during fluctuating money circumstances. For people utilizing dependable accommodation money or simply continuous cash, yet, those mortgages gives a handy together with economical finance choice.